A flip to the USA or the UK - a tax nightmare

European founders often consider relocating the HQ of their startup from Europe to the USA (or the UK). But the flip could have painful taxation consequences.

There are numerous reasons why founders wish to relocate the HQ of their startup to the USA or the UK:

- scaling ambitions,

- their primary market is in the USA, not in Europe,

- access to capital for fundraising,

- preparations for an exit.

It is rarely necessary to relocate the HQ to the USA/UK, but it is often helpful to the founders' commercial ambitions.

What does relocation of the HQ practically mean?

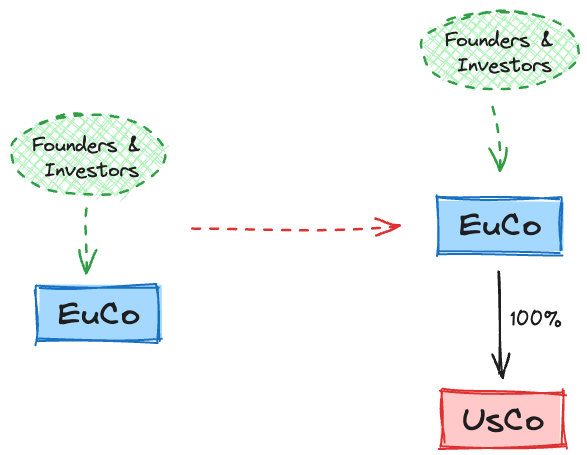

Typically, the starting situation is one limited liability company incorporated in one of the EU countries (EuCo). The target structure is a USA corporation, usually a Delaware C-corp (UsCo), owned by the founders and the investors, and the UsCo wholly owns the previously existing EuCo. In the case of relocation to the UK, the diagram remains the same - replace UsCo with UkCo.

This flip works mechanically because Founders and Investors contribute their shares in EuCo to the UsCo, and they receive shares in UsCo in exchange. Essentially, this is a share swap. In the eyes of a corporate lawyer, there are multiple ways to execute this transaction, such as capital increase by contribution in kind, merger, or sale.

There are also many variations regarding the details, such as the role of each entity, which is a trading entity, whether UsCo will only be a holding entity, where we keep the IP, etc. However, it is not the purpose of this post to go into these details.

You should, however, know that the flip is not that challenging from the corporate law perspective. For an experienced EU/US/UK team of lawyers, it should be, in fact, relatively easy. And when something is easy, there is always "a but".

Taxation could be a show-stopper.

Doing business in the EU is friendlier to the entrepreneurs than the public realises. Nlaw advises on transactions in the EU, England, and the USA, and similar projects are often easier to implement in the EU.

Thanks to the Council Directive 2009/133/EC of 19 October 2009, share swaps, divisions, mergers and asset transfers are (subject to some conditions and limitations) tax neutral. That means that the flip, as described above, should not require anyone to pay any tax.

Here comes "the but": one of the conditions for tax neutrality is that the share swap is done between entities incorporated in the EU.

In other words, if the Shareholders and Investors are also EU tax residents, a share swap from the EU to the US/UK is a taxable event.

This means that flipping your startup's HQ from the EU to the US/UK will be taxed as if you sold it. Because no price is agreed upon, your tax authority would most likely apply the fair market value price of those shares, as established by an expert evaluation. This is a big problem, as investors and/or founders would not have the liquidity to pay for such a tax event.

There must be a way around this.

Sadly, there is no easy way around this challenge. But there are some options on how to go about this situation or how to prevent from finding yourself in it.

Check your local tax rules.

In this post, we refer to the EU regulation. However, certain member states could have tax rules in place, which enable tax-neutral flip to the USA. You should check with your local tax/legal advisor for options.

Start of by incorporation in the US/UK from day one.

If you know from the beginning that it is highly likely that your main markets will be the US/UK, that you will not raise funds from EIF-backed VC funds, that you will likely raise from US/UK investors, then go to the USA from day one. We wrote a blog about this. Check it out.

Flip as early as possible.

If you flip early, chances are that the fair market value of shares in EuCo is zero or low. In such a case, even if the flip is a taxable event, the actual amount of taxes you will have to pay will be zero or low.

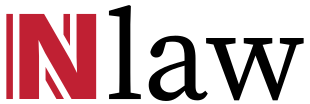

Establish a US/UK branch as an alternative.

If your motivation to move to the US/UK is only reputation or for the purpose of trading, consider establishing a branch (daughter company) overseas instead of relocating your main HQ. This means incorporating a new company in the US/UK, which EuCo will wholly own. Such a move does not impact the position of the founders and investors and does not cause any tax leakage. There could be, in certain cases, a taxable event on the level of EuCo, which has to be carefully analysed.