Will SEC's complaint against Binance change the Crypto landscape?

The SEC sued Coinbase and Binance for operating an unregistered securities exchange. While the users and the entrepreneurs in the USA are getting increasingly confused, things seem to be quite clear in the EU, thanks to MiCA.

The Securities Exchange Commission has had a busy couple of months in May and June. They filed complaints against Binance and Coinbase and sent shockwaves across the crypto world. While this story is still developing, let's delve into some intriguing details of these events.

It's still all about the "is it a security" debate

The classification of tokens as securities is a much-debated topic in the USA, but it is not a significant concern in the EU due to the regulations of MiFID and MiCA. In the EU, it is generally accepted that most crypto tokens are not considered securities.

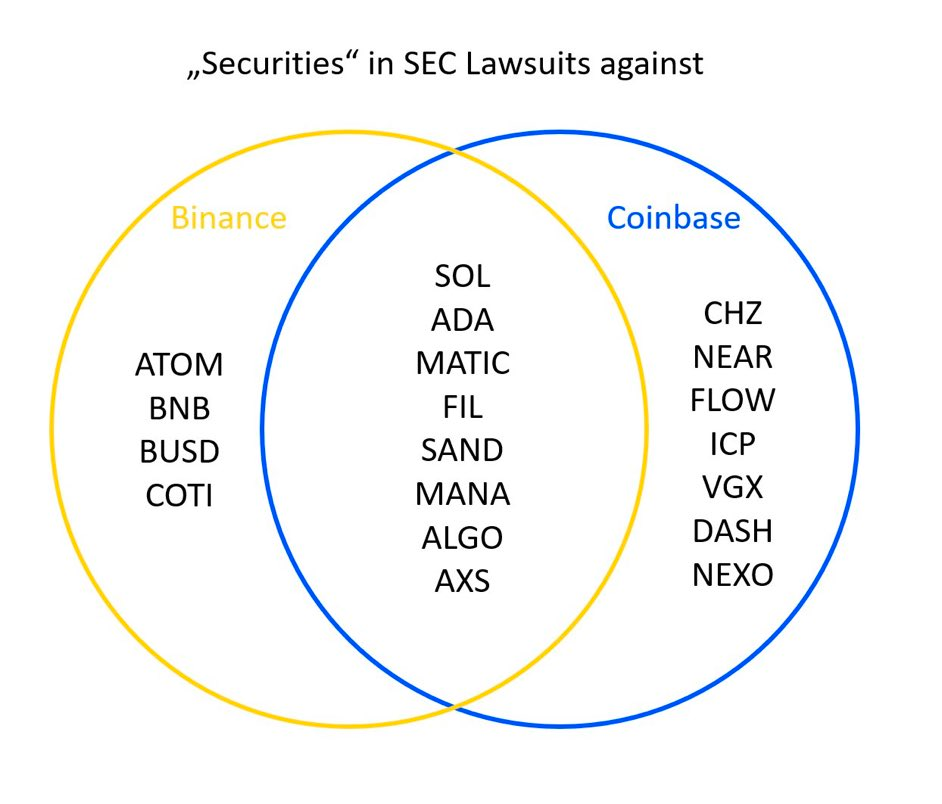

The SEC has declared that numerous tokens listed on Binance and Coindesk are securities. While Bitcoin is not considered a security and the status of Ether is still unclear, most other commonly used tokens are being labelled as securities by the SEC. Interestingly, the debate over whether tokens are securities has been ongoing in the USA since the initial coin offering of "the DAO" in 2016. Howey is still the most "popular guy" around.

Although it may seem complicated, the "Is it a security" question has far-reaching implications. If crypto exchanges were to trade tokens, which are securities, they would be required to register as securities exchanges. This significant distinction affects the exchanges, token issuers, and the SEC's authority. The SEC only has jurisdiction if these platforms offer trading of securities. That is why the debate centres around determining which digital assets are considered securities under federal law. Currently, it is unclear under the laws of the USA which, if any, digital assets fall into this category.

SEC has asserted in its complaints against Binance and Coinbase that numerous tokens are securities, and therefore both exchanges are in breach of law. The SEC claims that Binance and Coinbase should have complied with the regulation as platforms for trading securities.

Bringing out the big guns: SEC seeks an injunction against Binance

Binance is the largest crypto exchange by trading volume, accounting for over 40% of the global crypto market share. However, their US branch makes up 2% of its total volume. The SEC has filed a claim against Binance Holdings Limited (a Cayman entity), Bam Trading Services Inc. (a Delaware entity), Bam Management US Holdings Inc. (a Delaware entity), and the founder of Binance, Changpeng Zhaous, a citizen of Canada.

The complaint includes the standard SEC v Crypto allegations. It asserts that Binance worked to attract US customers to its unregulated international securities exchange, mixed investor funds with their own and violated securities laws. It claims that tokens are securities, and because Binance is not a registered securities exchange, it is in breach of law. The SEC complaint identifies 12 tokens it deems to be unregistered crypto asset securities. The target list includes some of the biggest names in crypto: SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI. Bitcoin and Ether were not named among the tokens deemed securities.

An interesting novelty, in this case, is that the SEC is seeking injunctive relief by asking the Court to order:

- an asset freeze,

- repatriation of customer assets in the US, and

- appointment of a Receiver (among other things).

It is not easy to secure a pre-trial injunction from the Court. In addition to showing a high likelihood of winning the case, the SEC must prove that such an injunction is urgent and necessary, as the final judgment would be too late to prevent harm. That's a high burden to meet. The SEC is arguing that the injunction is necessary on an expedited basis to ensure the safety of customer assets, quoting Binace's years of non-compliant business operation in the USA and questionable transfers and the custody and control of the Customer Assets.

If SEC were successful, that would have effectively meant the end of operations for Binance in the USA. A side effect of that would have most likely been the inability of the users to access their funds until the court-appointed receiver distributed the assets to the users.

If the Court grants the injunction, it means (among others) that the Court believes the named tokens are most likely securities. That would have most likely triggered a reaction from all other crypto exchanges, with their reactions either going in the direction of delisting these tokens or moving out of the USA market. The Court will likely decide on the injunction request quite soon.

One must notice a vast difference in the regulatory landscape between the USA and the EU. While the USA continues to rely on a court judgment about growing citruses from 1964, the EU is applying a new regulatory framework adopted recently (MiFID/MiCA).

Coinbase gets invited to the party

The complaint against Coinbase comes a day after the abovementioned complaint was filed against Binance. It did not come as a surprise, and it did not bring much surprise.

Similarly to other cases, the SEC claims that Coinbase has been offering securities trading and acting as an unregistered broker and securities exchange. SEC did not forget to mention Coinbase's staking program, which was launched in 2019 (even though this service has been changed by now).

The SEC seems to be nicer to Coinbase compared to Binance. The SEC asserts that 15 tokens listed in Coinbase are securities, and again they do not mention Bitcoin and Ether. Contrary to the Binance case, no injunction is requested, and SEC is seeking relief in the form of fines and dropping some of the services. No individual is named as a defendant, and no fraud is alleged.

Interestingly, Coinbase Wallet seems to be a rather material issue in the eyes of the SEC. They claim that Coinbase is a broker due to its wallet service. The SEC asserts that due to the wallet's ability to "route" (probably transfer) cryptos to third-party entities, such as decentralized exchanges, it renders a brokerage service. The SEC goes on and correctly explains that the wallet is a self-custody type of wallet because the private keys are kept by the customer in its device and not by Coinbase. The conclusion is concerning. It does not seem that the SEC failed to notice the difference between the assets in custody by Coinbase and the assets in the Coinbase Wallet, which are essentially in the user's possession. Therefore it is clear that the SEC also believes it has jurisdiction over self-custody wallets. This logic seems far-fetched, but it is very dangerous.

The question of staking service is more slippery. The SEC asserts that Conibase's staking program is a security. The SEC doesn't expressly explain if they believe the ability to stake tokens by design, like ETH, makes their securities, and they only focus on the Coinbase offering of the staking service. Similar claims have been made in the Kraken case (which ended with a settlement). Objectively looking at it, it could be argued that there is a difference between direct on-chain staking and pooling of tokens via a trading platform and staking such assets afterwards.

There has been a lot of chat about how the SEC can first allow the listing of Coinbase in Nasdaq and is now suing Coinbase for the alleged non-compliance. This logic does not make sense. In the listing process, while the offering documentation is reviewed, such review does not encompass legal, due diligence and compliance with the issuing company's business. Therefore, this argument should not be accepted as a valid one.

The EU giggles and observes from the side

Compared to the USA, it is hard to overstate how different crypto-asset treatment is in the EU. MiCA regulation was welcomed with mixed feelings. This is not surprising as it is the first broader regulatory act governing crypto. It has been criticised for hindering growth, innovation and development. However, it might become a growth driver by providing clear and transparent rules.

MiCA was created because it was acknowledged that most crypto-assets don't fall under current EU securities regulations. Hence, a unique EU-level regulation was necessary to address this issue. The EU's approach was completely different from the USA, which is trying to apply ancient rules to a new occurrence.

The EU offers a relatively straightforward set of rules, enabling companies to conduct business without unreasonable regulatory risks. That also draws the costs down and makes the EU an attractive market for crypto services providers.

It's not over yet

This story has just started, and unless Coinbase and Binance decide to settle, they won't end anytime soon. We will continue to follow and see how they evolve.

There could be some immediate actions to be taken by the services providers right now, such as:

- refraining from providing any other crypto but Bitcoin (and perhaps Ether) in the USA,

- focus on markets with clear rules (such as the EU),

- continue to widely interpret the rules of the Howey test,

- continue as it is, and wait for the outcome of the cases launched against the big players.